- Fundraising for the Rest of Us

- Posts

- Fundraising starts *before* your pitch

Fundraising starts *before* your pitch

How to build your fundraising strategy + get involved as a beta reader!

Hey friends,

Since announcing Fundraising for the Rest of Us, the response has been incredibly meaningful to me. So many of you have shared your excitement, offered support, and even asked about hosting a future book signing! It’s been humbling and energizing and has made me even more committed to writing something that’s tactically useful to the founders and funders who have been left out of the traditional fundraising narrative.

We’ve already welcomed our first two batches of beta readers, and the feedback and stories I’ve received so far are powerful. It’s vulnerable sharing early drafts, but the value of writing this with our community is undeniable.

This week, I’m sharing a short excerpt from Chapter 3: Developing a Comprehensive Fundraising Strategy. If you’re a beta reader, you can access the full chapter now. If you’re not yet, there’s still time to join! Just fill this out: Beta Reader Interest Form

The Brutal Math of Fundraising

Most founders start fundraising by jumping straight into pitching, but a successful fundraise doesn't begin with your deck. It begins with a strategy. Without one, you risk wasting time, burning out, or chasing the wrong capital altogether.

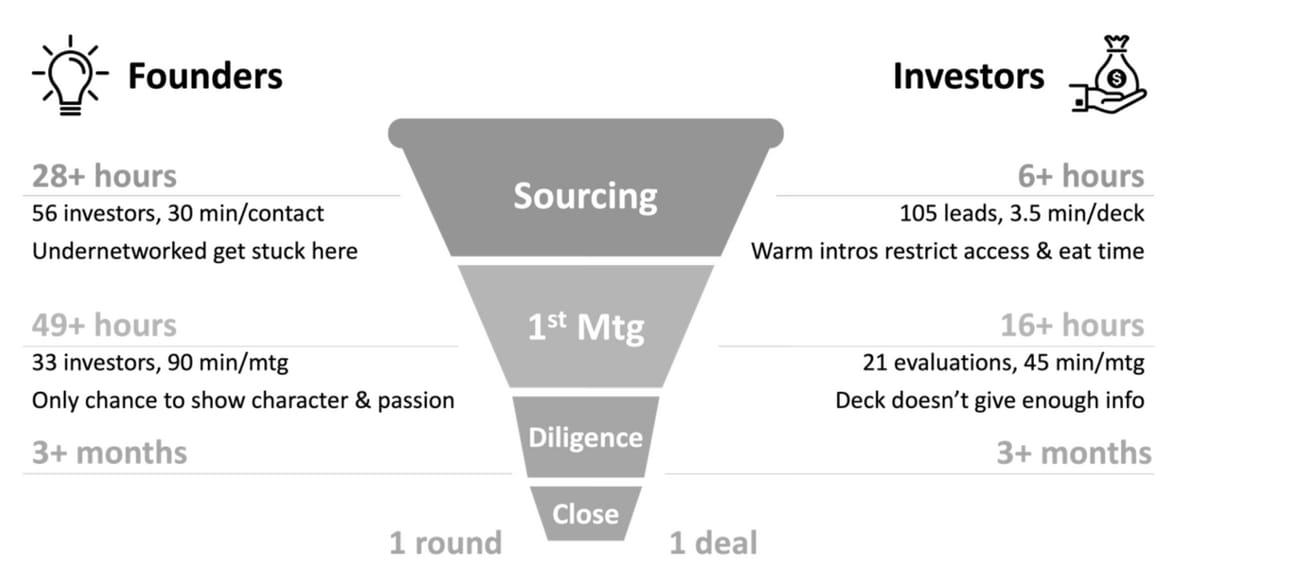

Here's something no one tells you: fundraising is incredibly inefficient for everyone involved. On average, early-stage founders who close a round reach out to 56 investors. Assume you take about thirty minutes per contact to do initial research and write your personal email – that's about twenty-eight hours of work right off the bat, just for initial contact.

Of those fifty-six inquiries, you'll get a first meeting with roughly thirty-three investors. That's another forty-nine hours of time for research, pitch refinement, and actual meetings. Then, if you make it into due diligence, expect another three months on average.

Meanwhile, investors spend about 3.44 minutes reviewing a deck before deciding if they want to take a meeting.

If you're part of "the rest of us" know that this data comes from people who did close funding rounds, and funding predominantly goes to white men. For the rest of us, anticipate a much longer process because we'll have to talk to a greater number of investors, take more meetings, and go through more scrutiny during diligence.

Strategy Before Slides

Before you commit to raising equity capital, take a step back and ask yourself: Is this really the right path for me and my business? Working through your pitch can actually help you answer that question. As you move through your deck, you may realize that your company doesn't align with traditional VC expectations, and that is absolutely okay.

Equity fundraising has been overly romanticized. It's often portrayed as the standard route to success, but in reality, it's just one of many options. What matters most is building something sustainable and aligned with your goals.

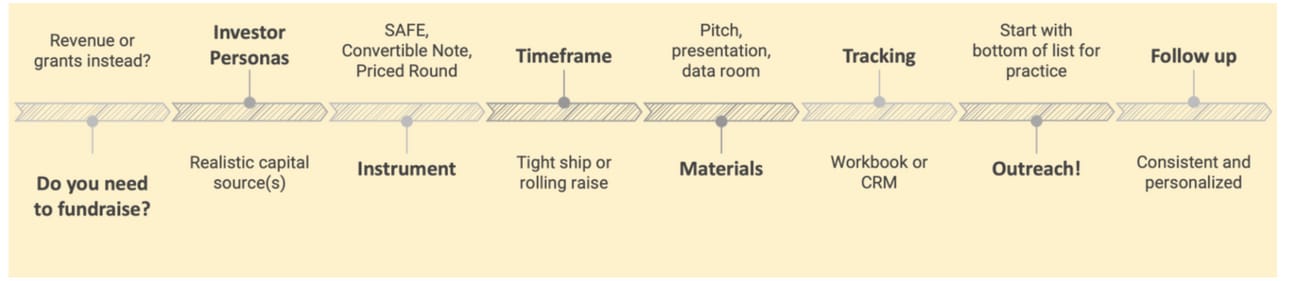

If, after reflection, you decide that raising capital is the right path for you, there are a few important steps to take before you start sending emails and scheduling pitches:

Define your investor personas. Who are the right types of investors for your business and your round? What are they looking for, and how can you best align with that?

Set a fundraising goal. This is often the biggest challenge for founders, because there is no one-size-fits-all answer. Instead of trying to figure out how much money you need to raise, ask yourself, “What is my next fundraising milestone, and what do I need to reach it?” Don’t just pick a number; be sure your number is rooted in strategy.

Set a timeline. Fundraising is seasonal and tends to follow the school calendar. Fall (September to mid-December) is peak fundraising season. Mid-January through February and spring (March through May) are also strong windows. Summer and end-of-year holidays are tough times to raise.

Start strategically. Begin your outreach with your lower-priority investors. This gives you space to refine your delivery and handle inevitable curveballs before stepping into high-stakes meetings.

Practice your pitch. Before you meet with a single investor, get your reps in. Say it out loud. Record yourself. Practice with friends, advisors, or other founders. Trust me, there is no substitute for practicing your pitch out loud. Saying it in your head isn't the same.

The fundraising process can be chaotic. Once you're in it, you're juggling a lot of conversations and follow-ups. Decide ahead of time how you'll stay organized, and remember: personalization is key. A targeted, thoughtful message has a much higher chance of getting a response than a generic copy-paste.

Fundraising for the Rest of Us will feature real founder stories that reflect a wide range of lived experiences, not just my own.

If you’ve developed a fundraising strategy, hit unexpected walls, or found surprising breakthroughs, I’d love to hear about it. Your story might help someone else navigate their path with more clarity and confidence.

Join the Beta Reader Community

Want early access to chapters, a voice in shaping the book, and a space to connect with other thoughtful people in the startup ecosystem?

Apply to be a beta reader here: Beta Reader Interest Form

Beta readers also get access to a private Slack community and behind-the-scenes updates on how the book is evolving in real time.

I’ll be back next week with more!

Allison