- Fundraising for the Rest of Us

- Posts

- Pitch decks are exhausting. Let's make them useful.

Pitch decks are exhausting. Let's make them useful.

Chapter 5 preview: the go-to pitch framework for hundreds of founders

Hi friends,

Here’s something you might not know about writing a book with a community: it’s incredible but also kind of overwhelming.

Beta readers have left hundreds of comments across the early chapters, including things they love, find confusing, and suggestions to add, clarify, or rethink. Some comments are just a sentence, while others are paragraphs long. I read every single one.

It’s amazing and exactly what I hoped for, but it’s daunting to know that once I’ve collected all this feedback, I need to synthesize and integrate it into something cohesive and useful. That’s what makes this book different, though. It isn’t just based on one person’s story or one type of founder. I’m shaping it with the voices of people who have lived this process and experienced it in different ways.

This week, I’m releasing Chapter 5 from my book, Fundraising for the Rest of Us, to beta readers: The Core 10 Pitch Framework. Below is a short preview, but if you want access to the full chapter and future ones, I’d love to have you join as a beta reader. Apply here!

Creating your pitch deck can feel like a full-time job you never asked for. You’re constantly tweaking it, getting flooded with (often conflicting) feedback, and wondering why you need one in the first place. Can’t you just skip to the conversation?

The short answer: not really. Pitch decks are still a standard part of the fundraising process. Investors expect them, and like it or not, they aren’t going away anytime soon. Here’s a more helpful way to think about it: your pitch deck isn’t just a fundraising tool, it’s a clarity tool. It forces you to distill your story, your traction, your vision, and your strategy into clear, understandable pieces. That’s not easy, but it’s incredibly valuable.

Part of what makes pitching so hard is that there’s no one “right” way to do it. Every investor has a different opinion. You will get conflicting advice, often from well-meaning people, and yes, it will be frustrating. Founders from historically excluded groups often get even more feedback, often focused on “fixing” their tone or delivery, rather than evaluating the business itself.

Here’s what you need to remember: your job is to listen, evaluate the source and the context, and then decide what to take in and what to let go.

The most effective pitch is one that feels authentic to you, your voice, your company, your vision, and that you can present with confidence and clarity.

The Core 10 Pitch Framework

A good pitch deck shows investors that:

You understand the problem and the opportunity.

You have a strategy to execute.

You can communicate your value clearly.

You’re worth spending more time with.

The goal isn’t to say everything, but to earn the next conversation.

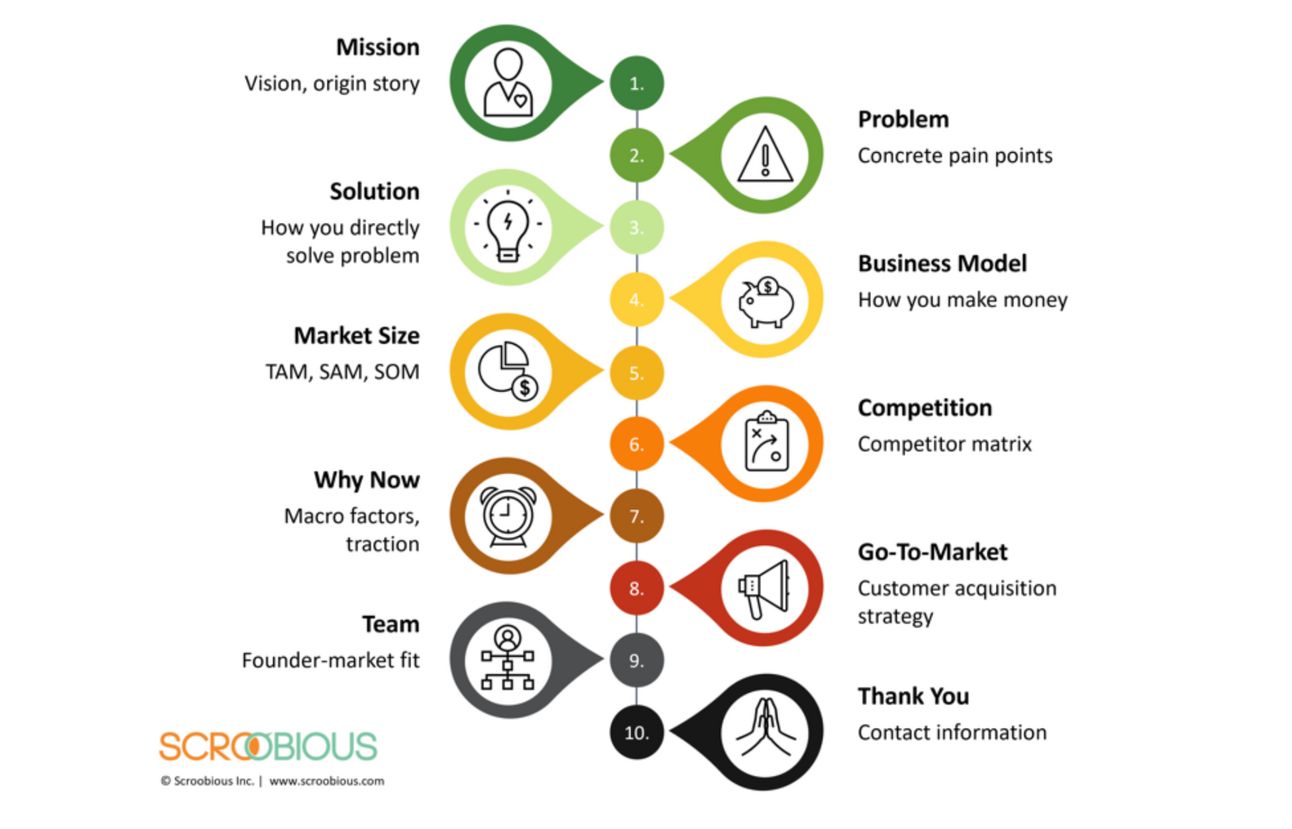

At Scroobious, we’ve developed a recommended structure for pre-seed and seed-stage decks based on years of experience, research, founder education, and interviews with hundreds of investors. There is no “one right way” to pitch, and you absolutely don’t have to follow this structure slide-for-slide. But I strongly recommend covering each of the ten topics, even if you change the order.

Here are the Core 10 Pitch Framework sections:

Mission

Problem

Solution

Business Model

Market Size

Competition

Why Now?

Go To Market

Team

Thank you

We’re going to dive deep into each section of the pitch in Fundraising for the Rest of Us, but at a broad level, here’s what you’re aiming for:

Mission, Problem, and Solution: The first three sections are critical. If investors don’t understand why you started this company, what problem you’re solving, and how you’re solving it in a compelling way, nothing else matters. These are your tickets to the game, and why they come first in the narrative. Without belief in the story, the business case won’t land. Once you’ve established that foundation, the rest of your pitch focuses on the mechanics of how you’ll execute.

Business Model: Show how you make money. You don’t need every operational detail, just a clear and simple explanation of how revenue is created and captured.

Market Size: Investors need to see that this is a meaningful opportunity. A bottom-up market size based on your specific business model and target customers is ideal. If you’ve never done this before, don’t panic – anyone can learn how, and we’ll walk through it.

Competition, Why Now, and Go To Market: These sections show you understand the landscape, why timing matters, and how you’ll reach your audience. They’re about showing clarity, not perfection.

Team: Investors back people. Share why you and your team are uniquely positioned to execute. If you’re a solo founder or building a lean team, that’s ok, and we’ll cover how to talk about filling the gaps.

Thank you: End with gratitude and make it easy to follow up. Include your contact information, thank the investor for their time, and include any other asks, like key introductions.

The goal of your pitch is not to close the deal in one meeting; it’s to get to the next conversation. You’re telling a story that says: “Here’s what I’m building, here’s why it matters, and here’s how I’m doing it.”

In the book, we will take you through these 10 sections, one at a time. You’ll see real-world examples of how founders have told their stories and mitigated risk across industries and identities. If you’d like to dig deeper, apply to become a beta reader, or check out our full library of resources at Scroobious.

That’s it for this week! Thanks for reading and happy building.