- Fundraising for the Rest of Us

- Posts

- The Hidden Risks of SAFEs and Convertible Notes

The Hidden Risks of SAFEs and Convertible Notes

Chapter 4 preview about what to know before raising with these instruments

Hi friends,

Since launching the beta reader program, this process has only reinforced how valuable it is to write this book with our community. Every week, through the beta reader platform and in our private Slack, I’m engaging in thoughtful discussions, responding to insightful questions, and collecting founder stories that deserve to be heard. The feedback I’ve received on the early chapters has already helped me sharpen the content, and honestly, it’s made the whole project feel more connected and real.

This week, I’m releasing Chapter 4 to our beta readers: Fundraising Vehicles. It’s a topic I feel especially strongly about because too many founders aren’t told about the risks that come with these early-stage instruments. Below, I’m sharing snippets from Chapter 4. If you’d like to read the full chapter and help shape the book, apply to be a beta reader!

When you raise capital, you’re essentially exchanging ownership in your company, your equity, for money. But figuring out how much that equity is worth can be tricky, especially in the early stages. At this point, you might not have revenue, customers, or even a finished product. So, how do you assign a dollar value to your company when there’s not a lot of data to back it up?

To solve this, early-stage startups often use fundraising instruments that allow them to bring in capital without having to set a firm valuation right away. Instead of selling shares at a set price, you're offering investors the right to receive shares in the future after your company grows and its value becomes clearer.

The two most common tools for this are:

SAFEs (Simple Agreements for Future Equity)

Convertible notes

Both allow you to raise money now and delay pricing the equity until a future round, typically when a larger investment sets a clear valuation. This gives you time to hit key milestones and increase your company’s worth before issuing shares.

Both have their risks, which are easy to overlook while you're busy building your company.

Let’s walk through how each of these works, their pros and cons, and how to think about which might be right for your situation.

📖 Want to learn more about fundraising vehicles, including how to structure your first priced round? I am still accepting new beta readers for my upcoming book, Fundraising for the Rest of Us. Just fill out the interest form.

SAFEs 101:

Pros: Founder-friendly and easy to set up.

Cons: Dilution can cause you to give away more of your company than planned.

SAFEs (Simple Agreements for Future Equity) were introduced by Y Combinator and have quickly become the most common way for early-stage startups to raise capital. They were designed to be straightforward and founder-friendly, giving startups a way to secure funding without having to set a valuation or take on debt right away.

A SAFE isn’t a loan, it doesn’t come with interest, and there’s no repayment schedule. Instead, it’s an agreement that allows an investor’s money to convert into equity (ownership in your company) later on, usually during your first priced round, like a Series A, when a formal valuation is established.

Unlike convertible notes, SAFEs don’t have a maturity date, meaning they can technically remain outstanding indefinitely if a conversion event never happens. That’s part of what makes them riskier for investors, but also simpler and faster for everyone involved.

Sound too good to be true? Raising money always comes with strings attached, and SAFEs are no different.

The risk of stacking SAFEs: understanding dilution

SAFEs are a powerful fundraising tool, but they come with a tradeoff that’s easy to overlook: dilution.

If you’re not careful, stacking multiple SAFEs over time can lead to more ownership loss than you expect.

Here’s what happens: every time you raise money using a SAFE, you’re offering investors the right to receive future equity, usually at a discount or based on a valuation cap. But because SAFEs don’t convert immediately into shares, they don’t show up on your cap table in real-time. That means it’s easy to lose track of how much ownership you’re promising to future investors.

This becomes especially risky when you raise SAFEs gradually, what’s known as “rolling SAFEs.” Instead of doing a single, structured round, you raise small amounts here and there as needed, sometimes over months or even years. This approach can be helpful for getting capital in the door quickly, but it also creates a blind spot.

This kind of SAFE stacking is particularly common among the rest of us because these founders often face more difficulty closing large, traditional rounds. They're more likely to raise capital in smaller checks from individual angels or early supporters over a longer period of time.

This piecemeal approach, while resourceful and often the only viable option, can result in a buildup of rolling SAFEs without clear visibility into how much equity is being committed.

It’s not a failure of planning. It’s a reflection of the systemic inequities in access to capital. But it makes it even more important to stay proactive: model your cap table as you go, understand how each new SAFE adds to future dilution, and don’t hesitate to ask for help.

Awareness is power, and you deserve to fundraise with your eyes wide open.

Convertible Notes 101

Pros: Some investors prefer this fundraising vehicle.

Cons: Founders may have to pay the money back, plus interest.

A convertible note is a more traditional fundraising tool that operates similarly to a SAFE but with a few key differences. Unlike a SAFE, a convertible note is debt. It functions like a loan with a maturity date and accrues interest over time.

If the note does not convert into equity before its maturity date, the company technically owes the investor the original investment amount plus accrued interest.

That may sound stressful, but don’t panic. Many convertible notes convert well before they reach maturity, but it’s still critical to understand how they work so you’re not blindsided like I was.

At my last company, the medical device startup, we were revenue-generating, but the big returns in that industry don’t come early. They come years down the road after the regulatory process and late-stage clinical trials with pharmaceutical partners, when you’re able to market to practitioners and patients. It’s an extremely capital-intensive journey, which is why large institutional funding rounds are often essential for survival.

While we were urgently trying to raise our Series B, we failed to notice that the maturity date on a sizable convertible note from a venture capital firm was rapidly approaching. When it hit, I got a call from the general partner who was our lead at the fund. It was not a friendly call, nor was it a short one. I had to draw on every ounce of my skill, persuasion, and character to convince him not to call the note and demand repayment (plus interest), which would have bankrupted us.

Investors might prefer a convertible note because it is structured as a loan, offering more security than SAFEs. Investors know that:

If a priced round happens, the note converts into equity, usually with a discount or valuation cap, just like a SAFE.

If a priced round doesn’t happen in time, they have the right to be repaid (plus interest).

The maturity date is the biggest thing to keep on your radar. If you haven’t raised a priced round by that date, your investors might request repayment, or you may need to renegotiate terms, which can get tricky and time-consuming. In some cases, the looming maturity date can even pressure you into raising before you're truly ready.

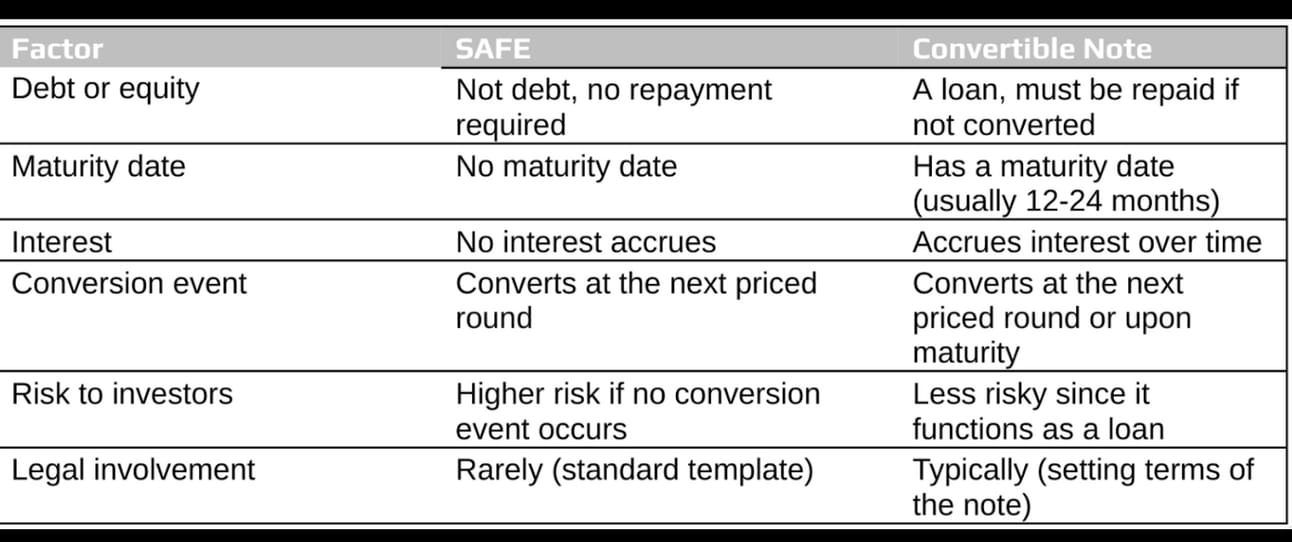

Key differences between SAFEs and Convertible Notes:

SAFEs and Convertible Notes are a great way to fund your early-stage startup, but it's important to understand the potential risks. As often is the case for the rest of us, knowledge is power. Go into every fundraising meeting with a plan and knowing your options.

These tools are just the first step of your fundraising journey. The goal of raising a SAFE or Convertible Note is to eventually raise a price round.

We discuss priced rounds, including how to read a term sheet, in my book, Fundraising for the Rest of Us.

Want to get an early look at the book? Apply to become a beta reader!

Thanks for reading!

Until next time,

Allison